Why people do not buy travel insurance

"Probably I will not need it".

"It is unlikely I will file an insurance claim"

"Additional expense."

Complacency.

These are a few reasons why people do not buy travel insurance. But what if, while on a trip, you get sick and needed to be hospitalized, are you ready for all the costs?

Travel insurance may not the first travel item you would purchase. You do not even research much about it because may be the colorless part of your travel planning.

So, is travel insurance worth it?

Generally speaking, it depends on how much risk you can tolerate and how much your travel insurance policy will cover.

As soon as your the aircraft you are in takes off, you are exposed to all sorts of risks, some of those you may not be able to handle financially.

The cost of travel insurance ranges from a few hundreds to a couple of thousands of pesos. The actual price you need to pay to insurance companies to have your trip covered depends on the duration of your travel, your destination, and the coverage limits of your insurance policy.

Considering the variety of risks in traveling, having a travel insurance policy is worth it.

In case something bad happens to you and the policy has been triggered, your travel insurance will help you recover.

If you cannot afford to lose the non-refundable money you have paid while planning for your trip, getting a travel insurance policy is a smart choice. Even Forbes agree to this.

On the other hand, if you are all safe and no unfortunate event happens, your travel insurance policy has given you peace of mind while you were traveling.

Actual experiences in servicing our clients

Travel insurance claims cases

Importance of having Medical Expense coverage while traveling

Years ago, one of our clients traveled to Europe. Since travel insurance is required for Filipinos in applying for Schengen visa, he needed to purchase travel insurance weeks before his Euro trip, upon his visa application.

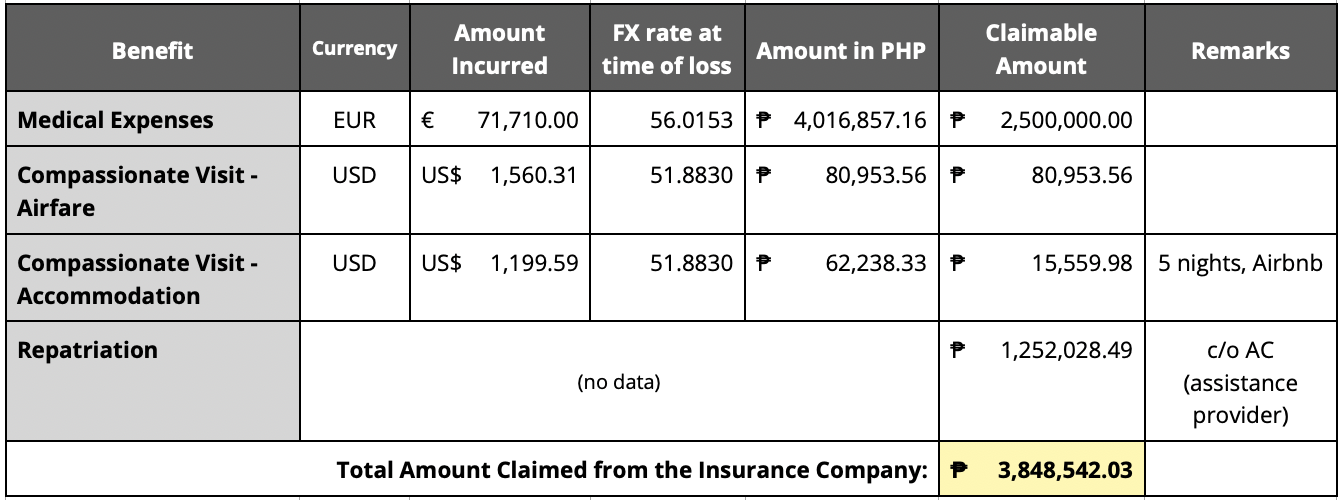

While he was in Europe, unfortunately, he got to an accident while riding a bicycle and was brought to a nearby hospital. His medical bill reached more than EUR 45,000 (or Php 3,000,0000). His travel insurance policy covered majority or the cost (he exhausted his policy’s medical expense limit of Php 2.5 million).

Also, the "Compassionate Visit" coverage responded and the insurance policy paid off a large part of the expenses in flying-in the family members of the insured, to be with him while he was hospitalized.

The total amount claimed was around Php 3.8+ million

Travel Insurance claim evaluation

Baggage Delay benefit relieves travel inconveniences

Another client of TRAVELINSURANCE.com.ph, while traveling with her family, the arrival of their luggages were delayed. The baggage delay coverage of her family members' policies were so critical as when they reached their destination (and their luggages did not), they needed clothes to wear so they had no choice but to shop for clothes.

They were able to reimburse the essential items they purchased including clothes, toiletries and some snacks, amounting to somewhere within 15k to 20k pesos.

How about we reverse the question.

Is traveling without insurance worth it?

You simply wanted to have a new travel adventure and didn't care if you have coverage.

You have saved some expenses by flying without travel insurance. For instance, for a one month to the states, you may have cut your expenses less 1,000 - 2,000 pesos for forgoing travel insurance for your US trip.

While traveling, you are exposed to a variety of risks, at times you won't know that will hit you.

In case you are involved in an accident or caught a virus, getting medical treatment overseas can be very expensive, not to mention medical evacuations and repatriations, if needed.

A small cost that you add to your travel budget can protect you from the worst disasters, including having to cancel your pre-paid travel expenses because of emergencies, or being sick while traveling abroad.

Medical treatment abroad are very expensive

For the average Filipino, Medical costs are much higher overseas than getting treated here in the Philippines. This is goes the same for developed countries, with higher costs of living.

Like in one of the case example, with a premium (the amount you pay to insurers to buy an insurance policy) of less than Php 1,600, the insurance company paid as much as Php 3,800,000+ for the medical expenses and for flying-in in the family members of the insured from Philippines to Europe and back.

Do you imagine yourself having the need to shell-out millions of Pesos due to medical costs if the unfortunate happens? It can wipe out your savings dedicated for something else.

Compensation to certain travel inconveniences

If you are more interested on the "travel" portion of the insurance, there are also non-medical benefits to cover unforeseen, unfortunate events.

In case you do not have a travel insurance policy, during the unfortunate event, you potentially have the burden of losing thousands of pesos in case of:

- You need to cancel or cut-short your trip due to emergency cases and is unable to refund the pre-paid airline costs and hotel accommodations.

- Expenses due to meals or other necessities (possibly hotel accommodation) because your flights are delayed

- Clothing, toiletries and other essential items due to the arrival of your checked-in luggage has been delayed

- Repair or replacement expenses to your luggage that has been damaged during your travel

- Incidental expenses if you lost your travel documents (e.g. passport, etc).

- Being legally liable to pay another person or entity because you caused an accident to other people or damaged some other's property due to your own negligence

Like my second case example, wherein their travel insurance policies responded to the baggage delay claim. If they did not have a travel insurance policy, the hassle will remain a bad memory that included additional financial cost. As a consolation, the baggage delay benefit reimbursed the shopping they needed to make (they needed to buy clothes and some toiletries).

Would the airline company who mishandled the baggage provide any kind of compensation? Maybe some airlines will, but with their case, sadly the airline did not provide any compensation. The airline did not even acknowledge that it was their liability.

These unforeseen events can create a negative experience througout your travel. Having some benefits to help you financially can provide some relief to those travel hassles and helps you move forward and get back to you intented trip.

Destination is a factor

Insurance for domestic trips are inexpensive

There are people who get a way with not having travel insurance for domestic travels. If you have an HMO or medical insurance, you can already be covered for medical expenses while you're away from home. Despite that, travel insurance for domestic trips are very inexpensive and can compliment your medical or health insurance policy during your trip. Premium for domestic travel insurance will likely be less than Php 500, unless your local trip is more than 2 weeks.

Travels to not-so-far destinations

To some Filipinos, traveling to relatively near destinations like Thailand, Vietnam, Cambodia, Malaysia or Indonesia may get away in not getting their trips covered. Cost of medical treatment on these countries may be somewhat the same as what we have here in the Philippines so it’s okay for them to not be covered by a travel insurance policy.

More often than not, travels to these countries are only short, hence the cost of travel insurance will likely be affordable.

For instance, during short solo trip to Ho Chi Minh City, Vietnam to experience their Tet Holiday, the cost of my insurance is only Php 1,000. This is already on the high side (there are more affordable options) but since I was traveling alone, I wanted to take a travel insurance plan with higher coverage.

Again it is up to your risk tolerance if you want to take on all the risks to save a few bucks in not getting travel insurance.

For me, if I travel to any country, whether it's a 3-hour or an 18-hour flight, I appreciate having compensation for delays and protection for my personal baggage.

Traveling to developed regions

Normally, traveling to developed destinations, including those in the Americas, Australia, Japan, South Korea, HK, destinations in the European region, or even UAE, means expensive expenses - including incidental ones.

This suggests it is wise to have coverage to have protection in case something bad happens that could possibly hurt you financially.

Travel insurance for visa requirements

Schengen

For those traveling to Europe, most likely one of your destinations are within the Schengen region.

If you are a Philippine passport holder, getting a Schengen visa means you need to purchase a Schengen-approved travel medical insurance policy. It is a requirement upon visa application, so having travel insurance is a pre-requesite to traveling to this western part of Europe .

Other countries requring insurance

Some countries require visa applicants from the Philippines on a case-to-case basis.

Other benefits of having travel insurance

Protection for your family in case the worst happens to you

The fact that my family will get the benefits in case of my accidental death (knock on wood!), is already a big factor for me. Though I don't have children dependent on me, if the worst happens to me, the insurance proceeds will go my immediate family members - my parents and sibling.

Assistance hotline can be a handy tool

Normally, a travel insurance policy also includes an emergency assistance hotline. Whether it's a third party provider or an inhouse customer care center, the assistance provider can act as a concierge to get referrals for certain services.

Over the years I have not tried calling the 24/7 assistance hotline included in my insurance policy. But it is calming to know that that there is a safety net that can provide support in case the worst happens.

Considering all these make me always get a travel insurance policy each time I fly out the country. All the protection exceeds the cost of the premium you paid.

Or else, if luckily, I won't need to file a claim, I paid for peace of mind having coverage throughout my travel.

Security from the personal liabilities

It is less likely to happen and we do not even want to imagine it. But during our travel, what if we are legally liable to pay for something we have damaged due to our negligence?

Litigations can be stressful emotionally and financially. Having travel insurance with personal liability coverage can protect you from these forgettable instances.

Other things to consider

Include the cost of your travel insurance to your airfare budget

Every time I plan a trip and search for flights, I compare the cost of each. Sometimes a few thousands of pesos won’t matter. For example, a roundtrip airfare to the US that costs Php 70,000, comparing it to an a flight with better schedule may not be a big deal. Personally, I would spend the difference by buying travel insurance, that could cover my entire trip. Not necessarily the insurance add-on when doing online booking through airline websites, but from a knowledgable insurance representative or from websites with travel expertise. Yes, there are more options available from various insurance companies.

Pro tip: Check your travel insurance policy's period of coverage

Our team advises our clients to have make the duration of cover from your departure from Philippines up to your actual date of arrival back here in your home country. This will ensure your entire journey is protected - including your transit dates and while you are exploring different places within your destination.

Some travel insurance plans (often if free from your credit card or purchased from the airline) may cover you during period of conveyance so it would be best to read your insurance policy or ask the airline staff.

Read the policy wordings

You may have misunderstood the coverages or benefits indicated in the insurance policy or brochure. It is best to read the wordings including the exclusions before your actual trip. Clarify some items with your travel insurance agent or representative.

Conclusion

Getting a travel insurance policy it is something you need think about getting, once you have finalized your travel schedule.

Assessing all the ill-fated possibilities that can happen to you or your trip, having a travel insurance policy is worth it. Being covered with a travel insurance policy outweighs the associated risks and drawbacks of traveling.

That small amount of cost that you pay to insurance companies will give you wide range of coverage included medical expenses, personal accident coverage, benefits in case of travel inconveniences and baggage protection.

More often than not, a travel insurance policy also includes a 24/7 assistance hotline policyholders may reach that can also act as a virtual concierge.

With any kind of insurance, the best time to buy insurance is when you don’t need it.

A travel insurance policy can be purchased as soon as you have finalized your travel itinerary (especially the travel dates and destinations), or after you have booked your airline.

If you think you are not financially capable to pay for exorbitant medical expenses abroad in case you get hospitalized, yes, having travel insurance to cover your international trip is worth it.

Also, if you feel you have invested so much during organizing of your upcoming trip, you must consider buying a travel insurance policy.

Travel insurance encourages peace of mind during your journey, so all you have to do is enjoy your trip.

Do you have questions about travel insurance?

Send us a message through our Contact Us page.