What is the definition of travel insurance?

Travel insurance is a product that protects a covered person against various risks during the course of his or her trip.

A contract people buy before the start of their travel to protect them from losses caused by unforeseen events.

It may be a tragic event like being severly ill because of an acquired disease or a damaged luggage due to mishandling, travel insurance has numerous features that can protect policyholders from various travel-related risks.

An insurance product, it provides financial protection by compensating the traveler for losses that may occur while the insured traveler is away from home.

As defined by Investopedia, travel insurance helps cover financial losses associated with surprise circumstances that could ruin a trip, including illness, injury, accidents, flight or transportation delays, and other issues.

“Surprise circumstances” correspond to an unforeseen event, therefore it must be an uncontrollable event by any person or entity.

Because of its wide range of protection, it gives people peace of mind while traveling. In this way, all they have to think about is how to enjoy their trip.

What is a travel insurance policy?

An insurance policy is a legal contract between an individual or entity (the insured) and an insurance company (the insurer). This contract outlines the terms, conditions, coverage, and obligations of both parties regarding a specific type of insurance. Insurance policies are used to provide financial protection and compensation in the event of covered risks or losses.

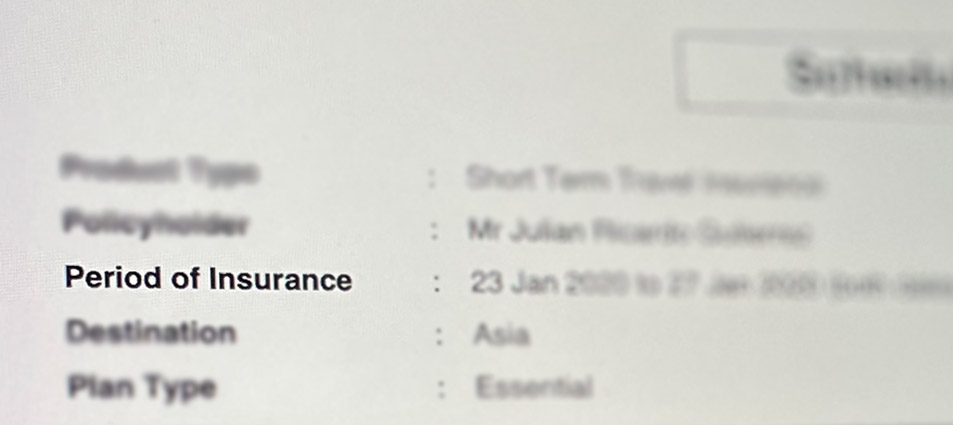

For travel-specific risks, a document called travel insurance policy is a contract between the insured traveler and the insurance company. It can serve as a proof that the person is covered by the insurance program.

Travel insurance documents usually indicate:

- The name of the traveler (insured person) and his/her policy number

- Duration of coverage

- List of coverages and its benefit limits

- Terms & Conditions

- Exclusions

Travel Insurance Policies in the Philippines

A travel insurance policy is fundamentally a personal accident insurance policy, designed to provide accident coverage while the insured person is outside the country.

LIke with most insurance companies in the region, their travel insurance products are created by underwriters and administered by their “Accident & Health” or similar departments.

Travel insurance policies written by insurance companies in the Philippines require that the point of origin is within the Philippines.

A person based abroad, whether a Filipino citizen or not, cannot buy a travel insurance policy if his trip does not begin in the Philippines. Foreigners, who may want to buy travel insurance because of the lower cost cannot buy a policy here, if their trip will start somewhere else.

In the Philippines, a proof that a person is protected by travel insurance can be called a certificate of cover, a confirmation of coverage or simply a travel insurance policy. Traditonally it is in paper form, but nowadays digital policies are accepted and considered original.

Philippine-based travel insurers do not offer Cancel For Any Reason coverage.

Unlike those available abroad, there is no “cancel for any reason” coverage for travel insurance purchased in the Philippines.

This could correlate why travel insurance is more expensive if purchased abroad.

Contract Period

Normally an insurance policy is a one-year contract. But because travels usually have shorter durations, “short-term” policies have emerged. These single-trip travel insurance policies are the most common travel insurance plan purchased here in the Philippines.

In contrast, there are “annual travel insurance” policies, which is a one year renewable contract. More often than not, an annual travel insurance policy is a multi-trip travel insurance plan that covers an unlimited number of trips. These are designed for frequent travelers.

Evolution of travel insurance

More travel-related risks are now covered

Over the years, this ‘personal accident insurance’ product has evolved to add various coverages beyond fatal accidents. A common travel insurance plan now includes theft, trip cancellations, personal liability, medical expenses and other travel-specific risks.

Insurance companies have their own stand-alone insurance products like personal accident, liability, medical coverage which can possibly purchased independently. Since these insurance companies have the facility to cover such risks, they packaged these different insurance coverages into a single product incorporated to what we now know as travel insurance.

Because of the wide range of cover, a travel insurance policy can help travelers mitigate diverse risks associated with travel such as flight delays, medical emergencies, lost luggage, and other unforeseen and uncontrollable incidents.

Additionally, most travel insurance programs now have added access to a 24/7 assistance hotline that can come handy for certain situations.

Digital insurance policies

Soft copies of travel insurance policies are now widely used and accepted. A policy will likely have more than 10 pages, so considering the environment, you may opt not to print it, if not necessary.

Whether your travel insurance policy is in paper or in digital form, the coverages and features are the same. People can simply save their proof of insurance or policy on their mobile device. Some, however, print the first 1 or 2 pages indicating the names of the insured, the policy number and the emergency hotline number.

7 ways travel insurance can protect you:

1. Trip Cancellation and Termination Coverage:

This aspect of travel insurance reimburses you for non-refundable trip expenses if you need to cancel or cut short your trip due to covered reasons such as severe illnesses, serious injuries, or other unexpected, tragic events, ensuring you that you won't have the burden in case the airline or hotel does not want to refund the amount you paid for the unused airfare or accommodation you due to mentioned reasons.

2. Medical Expense Coverage:

Travel insurance typically includes coverage for medical emergencies that may occur while you are traveling. This can include doctor consultations, hospital stays, medications, and for some products, even follow-up medical expenses upon returning home, protecting your finances for unexpected costs due to treatments.

3. Personal Baggage Protection:

If your luggage or personal belongings are lost, stolen, or damaged during your trip, travel insurance can provide reimbursement for the replacement or repair of these items, making you at ease knowing your personal belongings are protected.

4. Travel Delay Coverage:

Travel insurance covers expenses like meals, accommodations, and transportation if your trip is delayed due to reasons beyond your control, such as weather-related delays or airline strikes. This benefit can pay for your meals or even accommodations if your flight has been delayed.

5. Travel Assistance Services:

Many travel insurance policies offer assistance services that can provide help with a variety of travel-related issues, such as finding medical facilities, replacing lost passports, or referrals to certain services. It has a dedicated 24/7 hotline to answer your inquiries and service requests.

6. Emergency Evacuation and Repatriation:

Whether provided by the insurance company itself or its partner assistance provider, in case of a serious medical emergency, travel insurance can cover the enormous costs associated with evacuating you to a medical facility and, in some cases, repatriating you to your home country.

7. Personal Liability Coverage:

Personal Liability is intended to protect you in case you are legally liable to pay for injuries to other persons or damage to other's properties due to your negligence.

Photo by Matthew Smith on Unsplash

Travel insurance policies can vary widely in terms of coverage, exclusions, and price. It is advisable to carefully read and understand the policy terms and conditions, as well as its exclusions, to ensure it meets your needs and provides the level of protection you want for your trip.

Travel Insurance policy provisions and exclusions

Point of origin

As discussed, travel insurance policies purchased here in the Philippines require that the point of origin is the Philippines.

Unless stated otherwise in writing, a policy bought from a Philippine-based insurance company will be invalid if the traveler’s trip would commence from other parts of the world.

Covered Period of a Travel Insurance Policy

For a single-trip travel insurance policy, the covered period is indicated in the insurance policy schedule or certificate of cover. This is the period of coverage the insured person applied for.

Ideally, it would start from the departure from the insured person's home country, up to his arrival date back. Normally, it can cover travels up to 180 days or 190 days. The coverage will end upon expiry of the policy or return to the insured's home country.

For multi-trip or commonly known as annual policies, even if the coverage period indicated in the insurance policy is one year, the duration of coverage is limited to a specific period. If an insured holds an annual policy, it is best to be aware of the maximum duration of coverage per trip, which can be 90 days, 60 days, 30 days per trip, or as stated in the insurance policy wordings.

Read the exclusions included in the insurance policy

Make sure to read the policy wordings including the exclusions of your travel insurance policy to be aware of its limitations.

Like all types of insurance policies, not all losses are covered. Insurance cannot cover each and every risk. Some risks are simply uncoverable and some are still unknown, hence underwriters exclude risks that lack studies yet. It is also part of the underwriting process to make the premium of the insurance plan affordable to the market.

For instance, pre-existing medical conditions are often not covered by a travel insurance policy. Some plans can provide "first medical assistance" for pre-existing conditions, however the covered amount is very limited.

Requirements in filing a claim

It is advisable to know what requirements will be needed in case you will be filing a claim, so you are aware what documents are needed to be produced during the travel.

For example, for medical expense coverage through reimbursement, you may need to request for a medical certificate from the doctor. For cases involving theft, a police report is usually required.

It is better that you are aware of the documents that needs to be furnished in case a claim happens in order for you to take action in procuring the documents and evidences. It will be difficult to obtain those documents that will support your case if you are already returned to the Philippines.

Travel insurance provides value to its policyholders

Travel is one of the greatest gifts we have but it entails a lot of risks. Insurance is meant to protect insured persons against potential losses.

Travel insurance is meant to provide peace of mind to travelers, making journeys worry-free, enabling policyholders savor each moment.

The question of wanting to have travel insurance depends on your risk apetite.

If you want to avoid having losses during your trip (or even before the start of your travel, on the case of Trip Cancellations), buying a travel insurance policy could be worth it.

Do you want to see your travel insurance options?

Check out a number of travel insurance plans here.